Consider for a moment how important the quality and extent of your site selection efforts are to your organization’s success. Remember that your efforts will ultimately direct substantial investments—making the stakes of getting it wrong very high. So one way to gauge the importance is to recognize the totality of the costs that are set into motion upon selection and approval of a site. All of the following are costs—some more obvious than others:

- The most obvious cost is the investment you’ll make in the construction of your facility which will vary based on facility purpose and location. An FSED will likely cost $10 million to construct and equip. Urgent care facilities and PCP offices are less but still represent significant investments. Consider then the investment of time and resources in an effective site selection study to be money well spent.

- In addition to construction costs, you should consider the ongoing operating costs associated with your facility (e.g., staffing of physicians, nurses and staff). Again, focusing the effort up-front to insure you’re picking the best site is the best way to optimize your long-term investment in both construction and ongoing operations.

- Also consider lost opportunity costs. How much more profitable would your investment be if you’d chosen the location that would yield 20% more visits than the location where you built?

- Equally important for health systems focused on increasing market share via expanding access points, your site selection and construction activities affect the actions and options of your competitors. If they are doing a better job of site selection than you, they will win the market share battle by taking from you.

So we agree—effective site selection is critically important in healthcare.

Since business success is based on identifying and leveraging competitive advantage, effective site selection is designed to identify where competitive advantage is maximized in terms of locational convenience. To accomplish that, here are a few of the important ingredients:

- Drive time is the best way to measure locational convenience. In some markets, public transportation access should be considered.

- Those who know the rules of maximizing your odds in casino blackjack know that the dealer’s cards are often more important than your own. Likewise, in site selection the locations of competitors are as important as the locations of potential patients. (And the impact of competition should be assessed differently based on the type of facility you are building.)

- Your analysis and forecasting cannot be based on zip codes or census tracts. They are too large, and in most cases, a site cannot serve an entire zip code uniformly. Instead your analysis should be more granular—based on where potential patients actually live, work, and attend school.

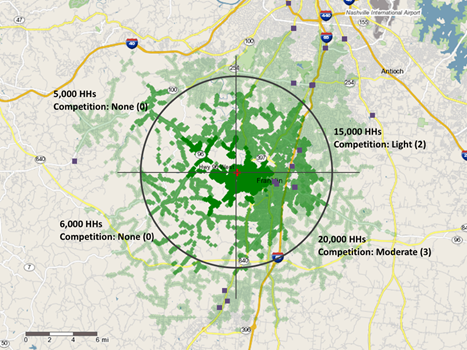

- Most site selection studies fail a fundamental test: they are provider-centric rather than patient-centric. This is not just wordplay. Unless your analysis is patient-centric, you will be relying on a false representation of the market. Here’s a quick example of what I mean—and why it matters. The provider-centric approach looks out from the proposed site, and quantifies the populations it sees and the level of competition. It’s not unusual that this approach considers quadrants like Figure 1 below where each green dot is a residential household and each purple square is a competitive urgent care center:

In this example, the analyst would pro-rate or otherwise reduce the household count in the two right quadrants based on the level of competition.

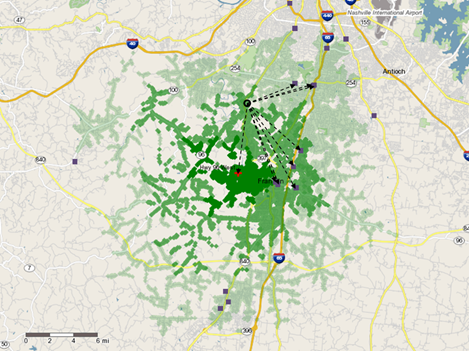

The real market involves thousands of choices made by prospective patients from thousands of locations where the world looks different as they look out from their vantage point—the patient-centric approach as shown in Figures 2A and 2B. (Once again, each green dot is a unique residential household, each purple square is a competitive urgent care, and the red plus is our potential site.)

potential patient from their location (circled)

potential patient from their location (circled)

The maps could be repeated for each of the thousands of potential patients from their respective homes, workplaces, and schools (the green dots). From each vantage point, the alternatives and their relative convenience is unique. Our forecast should reflect the relative convenience of our site to each potential patient.

Effective site selection must incorporate these factors and others. To ignore them is much too costly.

Braintree Health Marketing has conducted hundreds of site selection projects for leading healthcare providers and uses different methodologies for various types of facilities. Feel free to contact us if you think we could assist you in your site selection efforts.

Recent Comments